Scheme of Taxation of Undisclosed Income

- Blog|Income Tax|

- 13 Min Read

- By Taxmann

- |

- Last Updated on 22 May, 2023

Table of Contents

Check out Taxmann's Taxation of Loans Gifts & Cash Credits which comprehensively analyses the provisions relating to undisclosed income, gifts of money & movable/immovable property, along with relevant case laws. The relevant provisions of the Black Money Act and the Benami Property Transactions Act are also discussed.

1. Introduction

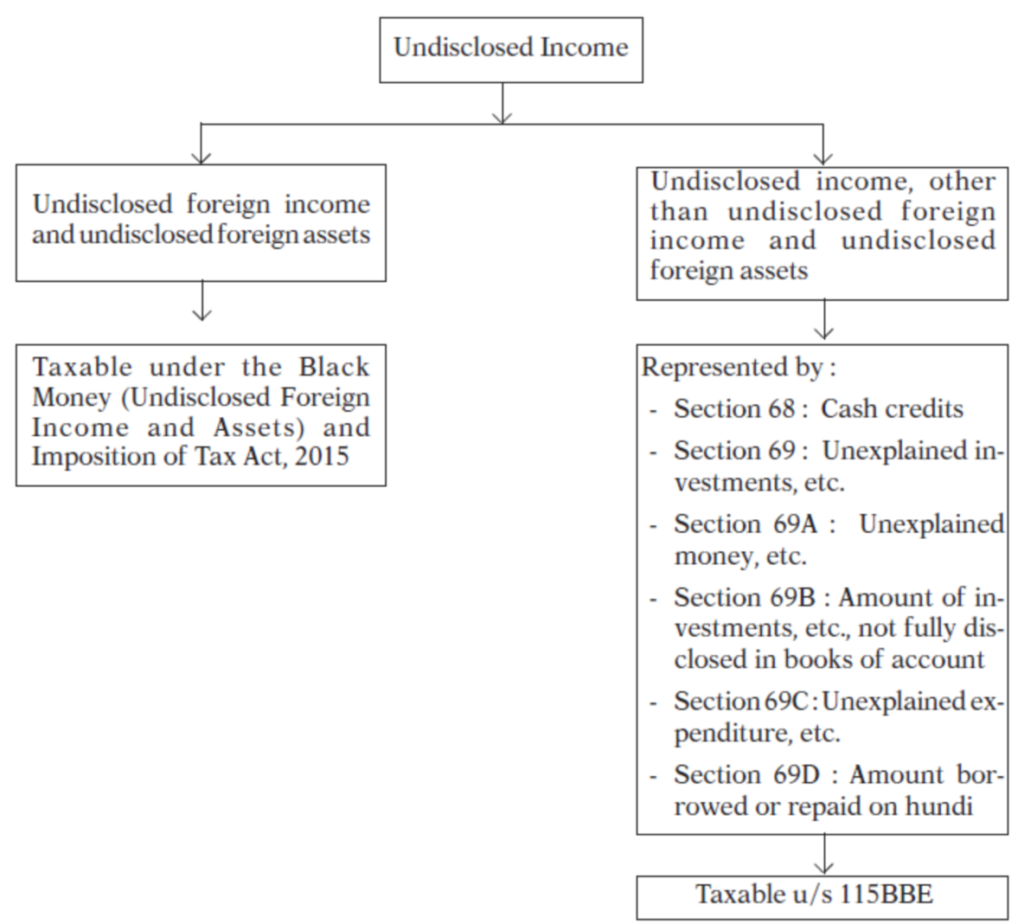

- Undisclosed foreign income and undisclosed foreign assets are taxable under the Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act, 2015 (BM Act).

- Undisclosed foreign income and assets are not taxable under sections 68 to 69D read with section 115BBE

- Sections 68 to 69D of the Income-tax Act,1961 (‘the Act’) deal with additions to total income, in respect of undisclosed income (other than undisclosed foreign income and undisclosed foreign assets) represented by:

-

- Unexplained Cash Credits [Section 68]

- Unexplained Investments [Section 69]

- Unexplained money, etc. [Section 69A]

- Amount of investments, etc., not fully disclosed in the books of account [Section 69B]

- Unexplained expenditure, etc. [Section 69C]

- Amount borrowed or repaid on Hundi [Section 69D]

- Section 115BBE of the Act provides for Tax on income referred to in section 68 or section 69 or section 69A or section 69B or section 69C or section 69D.

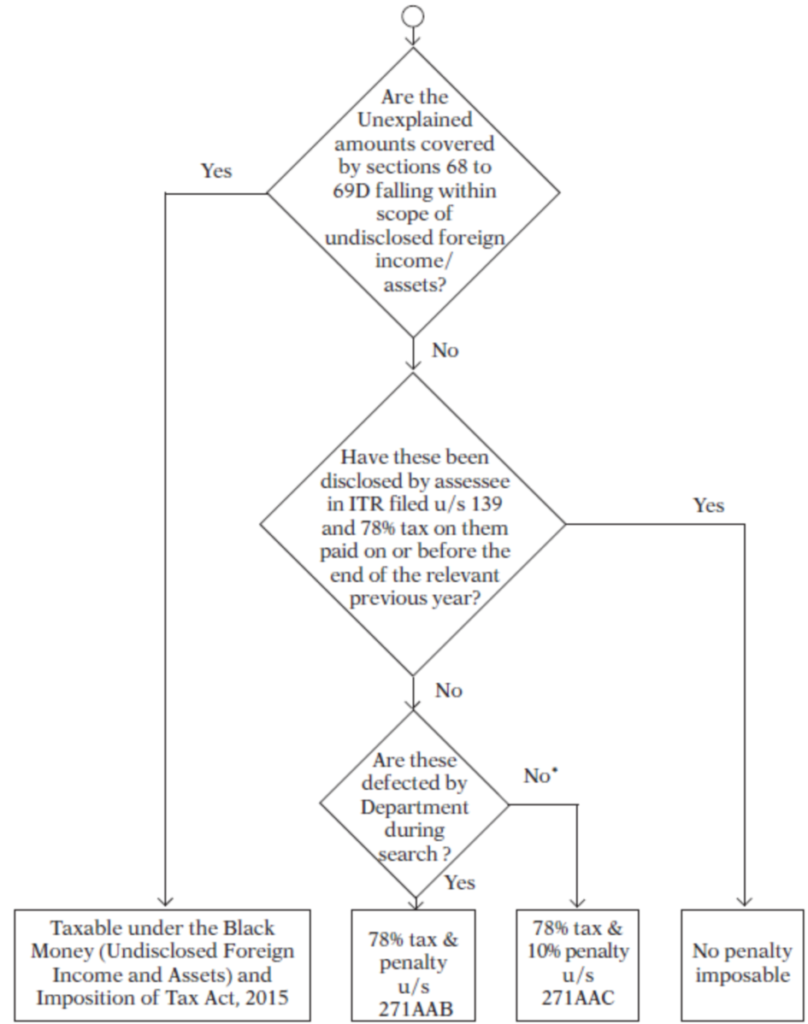

- Section 115BBE (1)(a) provides an on-tap Voluntary Disclosure Scheme (VDS) for disclosure in ITR by assessee in respect of undisclosed incomes covered by sections 68 to 69D of the Act as above.

- On-tap VDS u/s 115BBE(1) can be availed as under:

-

- Assessee should work out amount of undisclosed income and pay tax @ 78% (60% tax plus surcharge of 25% plus health and education cess of 3%) on or before 31st March of relevant previous year.

- Then disclose the amount of undisclosed income in Schedule OS of ITR forms (all ITR forms have the provision for this except ITR 1 and ITR 4S-Sugam)

- If not so disclosed and detected by Assessing Officer doing assessment, penalty of 10% so that effective rate comes to 85.8%

- Undisclosed foreign income and assets will be taxed under the BM Act and not u/s 115BBE(1) and hence can’t be disclosed in ITR in Schedule OS

- Voluntary disclosure u/s 115BBE(1) and paying 78% tax will not provide immunity from the Prohibition of Benami Property Transactions Act, 1988 (PBPT Act) or any other law such as Prevention of Corruption Act, 1988

2. Law applicable to taxation of undisclosed income/black money

The taxation of undisclosed income or black money is not exclusively governed by the provisions of the Income-tax Act, 1961 (‘the Act’). If undisclosed income is undisclosed foreign income or undisclosed foreign asset, then the same will be taxed under the Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act, 2015 (BM Act) with effect from 01-07-2015. Section 4 of the BM Act provides for the “scope of total undisclosed foreign income and asset” which shall be taxed under that Act. Section 4(1) of the BM Act provides that the total undisclosed foreign income and asset of any previous year of an assessee shall be,—

(a) the income from a source located outside India, which has not been disclosed in the return of income furnished by the assessee u/s 139 of the Act;

(b) the income from a source located outside India, in respect of which ITR was required to be filed u/s 139 of the Act but not filed by assessee;

(c) the value of undisclosed asset located outside India

As per section 2(2) of the BM Act, “assessee” means a person,—

(a) being a resident in India within the meaning of section 6 of the Income-tax Act, 1961 (43 of 1961) in the previous year; or

(b) being a non-resident or not ordinarily resident in India within the meaning of clause (6) of section 6 of the Income-tax Act, 1961 (43 of 1961) in the previous year, who was resident in India either in the previous year to which the income referred to in section 4 relates; or in the previous year in which the undisclosed asset located outside India was acquired:

Section 4(3) of the BM Act provides clearly that the income included in the total undisclosed foreign income and asset under this Act shall not form part of the total income under the Income-tax Act. Therefore, Income-tax Act will not apply if the BM Act applies to the undisclosed income in question.

If BM Act does not apply, then, undisclosed income (domestic undisclosed income) will be taxed under the provisions of sections 68 to 69D of the Income-tax Act. The additions under sections 68 to 69D are taxable under section 115BBE of the Act at effective flat tax rate of 78%.

2.1 Taxation of unexplained amounts under sections 68 to 69D at flat rate without allowing any deductions/threshold exemption limit – Section 115BBE

Section 115BBE was first inserted into the Act by Finance Act, 2012. Section 115BBE(1) was substituted by the Taxation Laws (Second Amendment) Act, 2016 with effect from assessment year 2017-18.

The following points are noteworthy:

- The Finance Act, 2012 inserted section 115BBE in the Act to tax unaccounted money represented by the additions covered by sections 68, 69, 69A, 69B, 69C and 69D at flat 30% without any deductions or basic threshold exemption limit.

- Section 115BBE was enacted ‘In order to curb the practice of laundering of unaccounted money by taking advantage of basic exemption limit’.

Section 115BBE, as originally inserted in the Act had the following lacunae:

(i) The tax rate was ridiculously low rate of 30% given that the income was not offered to tax but had to be detected and brought to tax.

(ii) There was no penalty for amounts of income detected and brought to tax under this head.

(iii) Further, section 115BBE nowhere envisaged a voluntary disclosure scheme where past unaccounted income can be declared by assessee in current ITR by paying flat tax. Also, the ITR forms had no provision for such voluntary disclosure.

The Taxation Laws (Second Amendment) Act, 2017 has cured the above lacunae by putting in place a new section 115BBE regime by substituting sub-section (1) of section 115BBE, inserting new section 271AAC and by inserting new sub-section (1A) in section 271AAB. Section 115BBE(2) was amended retrospectively w.e.f. 2017-18 by the Finance Act, 2018.

Section 115BBE(1), as applicable w.e.f. assessment year 2017-18, provides that where the total income of an assessee,—

(a) includes any income referred to in section 68, section 69, section 69A, section 69B, section 69C or section 69D and reflected in the return of income furnished under section 139;

(b) determined by the Assessing Officer includes any income referred to in section 68, section 69, section 69A, section 69B, section 69C or section 69D, if such income is not reflected in Income-tax return as per (a) above,

the income-tax payable shall be the aggregate of—

(i) the amount of income-tax calculated on the income referred to in clause (a) and clause (b), at the rate of sixty per cent; and

(ii) the amount of income-tax with which the assessee would have been chargeable had his total income been reduced by the amount of income referred to in clause (i).

A Surcharge of 25% and education cess of 4% are applicable on the 60% tax rate in section 115BBE taking the effective tax rate to 78%.

Section 115BBE(2), as amended by the Finance Act, 2018, provides that notwithstanding anything contained in the Act, no deduction in respect of any expenditure or allowance or set-off of any loss shall be allowed to the assessee under any provisions of the Act in computing income under section 115BBE(1).

Since the term ‘or set off of any loss’ was specifically inserted in section 115BBE(2) only vide the Finance Act, 2016, w.e.f. 01.04.2017, an assessee is entitled to claim set-off of loss against income determined under section 115BBE of the Act till the assessment year 2016-17.-CBDT Circular No.11/2019 dated 19.06.2019.

Sub-section (1A) of section 271AAB provides that Assessing Officer may, notwithstanding anything contained in any other provisions of this Act, direct that, in a case where search has been initiated under section 132 on or after 15-12-2016, the assessee shall pay:

(a) a penalty at the rate of 30% of the undisclosed income of the specified previous year, if the assessee—

(i) in the course of the search, in a statement under sub-section (4) of section 132, admits the undisclosed income and specifies the manner in which such income has been derived;

(ii) substantiates the manner in which the undisclosed income was derived; and

(iii) on or before the specified date—

(A) pays the tax, together with interest, if any, in respect of the undisclosed income; and

(B) furnishes the return of income for the specified previous year declaring such undisclosed income therein;

(b) a penalty at the rate of 60% of the undisclosed income of the specified previous year, if it is not covered under the provisions of clause (a);

The above penalty shall be in addition to tax, if any, payable by him.

Section 271AAC provides that:

(i) The Assessing Officer may direct that, in a case where the income determined includes any income referred to in section 68, section 69, section 69A, section 69B, section 69C or section 69D for any previous year, the assessee shall pay by way of penalty, in addition to tax payable under section 115BBE, a sum computed at the rate of 10% of the tax payable under clause (i) of sub-section (1) of section 115BBE.

(ii) However, such penalty shall not be imposed in respect of income referred to in section 68, section 69, section 69A, section 69B, section 69C or section 69D to the extent such income has been included by the assessee in the return of income furnished under section 139 and the tax in accordance with the provisions of clause (i) of sub-section (1) of section 115BBE has been paid on or before the end of the relevant previous year.

(iii) No penalty under section 270A shall be leviable in respect of any income referred to in section 68, section 69, section 69A, section 69B, section 69C or section 69D.

(iv) Provisions of sections 274 and 275 shall apply to penalty under section 271AAC.

2.1.1 Features of Section 115BBE regime

The features of the section 115BBE are as under:

(i) Voluntary disclosure of undisclosed income by assessee enabled by disclosure in a return filed under section 139. All Income-Tax Return forms for AY2017-18 except ITR-1 and ITR-4 Sugam form envisage disclosure of ‘Deemed income chargeable to tax u/s 115BBE’ in Schedule OS and its break-up as:

-

-

- Cash credits u/s 68

- Unexplained investments u/s 69

- Unexplained money etc. u/s 69A

- Undisclosed investments etc. u/s 69B

- Unexplained expenditure etc. u/s 69C

- Amount borrowed or repaid on hundi etc. u/s 69D

-

(ii) The effective tax rate (inclusive of 25% surcharge and Health and Education Cess of 4%) under section 115BBE is 78%.

(iii) Voluntary disclosure scheme under section 115BBE has no expiry date. It is ‘open on-tap’ unless in future section 115BBE is amended again to prohibit voluntary disclosure.

(iv) Voluntary disclosure must be accompanied by deposit of tax of 78% of the undisclosed income on or before the end of the relevant previous year. Relevant previous year means previous year in return of which voluntary disclosure is intended to be made.

(v) Voluntary disclosure should be made before any notice is issued by the Department or before any search or seizure is carried out. This is important as disclosure has to be in a return filed under section 139-be it original return or revised return or belated return.

Disclosure in updated Return or ITR-U will serve no useful purpose as the tax in respect of deemed income u/s 115BBE disclosed in ITR has to be paid on or before 31st March of the relevant previous year as required by section 271AAC.

Besides, there is no Schedule – OS like disclosure provision in updated return form ITR-U.

Instead of filing an updated return u/s 139(8A) to disclose incomes covered by sections 68 to 69D, it would be preferable to pay tax u/s 115BBE @ 78% by the end of current financial year and disclose the same in ITR for current financial year.

(vi) If voluntary disclosure not made and undisclosed income is detected in scrutiny assessment or reassessment or through survey (i.e. any manner other than search), then 10% penalty will apply under section 271AAC taking the effective burden to 85.8% of the undisclosed income. Filing of return in response to notice under section 142 or after survey is conducted will not be regarded as voluntary disclosure. Nor will disclosure in any return filed under section 148 be regarded as voluntary disclosure.

(vii) If undisclosed income is detected in any search, then in addition to the 10% penalty under section 271AAC, further penalty of 30% or 60% will be levied under new sub-section (1A) of section 271AAB.

(viii) No penalty is imposable under section 270A.

In Fakir Mohmed Haji Hasan v. CIT [2002] 120 Taxman 11 (Guj.), the Gujarat High Court laid down the following propositions:

- The scheme of sections 69, 69A, 69B and 69C of the Act would show that in cases where the nature and source of investments made by the assessee or the nature and source of acquisition of money, bullion, etc., owned by the assessee or the source of expenditure incurred by the assessee are not explained at all, or not satisfactorily explained, then the value of such investments and money, or value of articles not recorded in the books of account or the unexplained expenditure may be deemed to be the income of such assessee.

- It follows that the moment a satisfactory explanation is given about such nature and source by the assessee, then the source would stand disclosed and will, therefore, be known and the income would be treated under the appropriate head of income for assessment as per the provisions of the Act.

- However, when these provisions apply because no source is disclosed at all on the basis of which the income can be classified under one of the heads of income under section 14 of the Act, it would not be possible to classify such deemed income under any of these heads including ‘Income from other sources’ which have to be sources known or explained.

- When the income cannot be so classified under any one of the heads of income under section 14, it follows that the question of giving any deductions under the provisions which correspond to such heads of income will not arise.

- If it is possible to peg the income under any one of those heads by virtue of a satisfactory explanation being given, then these provisions of sections 69, 69A, 69B and 69C will not apply, in which event the provisions regarding deductions, etc., applicable to the relevant head of income under which such income falls will automatically be attracted.

- The opening words of section 14 ‘Save as otherwise provided by this Act’ clearly leave scope for ‘deemed income’ of the nature covered under the scheme of sections 69, 69A, 69B and 69C being treated separately, because such deemed income is not income from salary, house property, profits and gains of business or profession, or capital gains, nor is it income from ‘other sources’ because the provisions of sections 69, 69A, 69B, and 69C treat unexplained investments, unexplained money, bullion, etc., and unexplained expenditure as deemed income where the nature and source of investment, acquisition or expenditure, as the case may be, have not been explained or satisfactorily explained. Therefore, in these cases, the source not being known, such deemed income will not fall even under the head ‘Income from other sources’.

- Therefore, the corresponding deductions, which are applicable to the incomes under any of these various heads, will not be attracted in case of deemed incomes which are covered under the provisions of sections 69, 69A, 69B and 69C in view of the scheme of those provisions.

2.1.2 Whether section 115BBE is applicable to business receipts/business turnover omitted from profit and loss account and not included in ITR?

In the case of ACT Central Circle-13 Mumbai v. Rahil Agencies, order dated 23 November, 2016 the Tribunal held that section 115BBE does not apply to business receipts/business turnover. The Tribunal observed as under:

“19. We have considered rival contentions and found that by applying provisions of section 115BBE the AO has declined set off of business loss against income declared during the course of survey/search. The provisions of section 115BE are applicable on the income taxable under section 68, 69, 69A, 69B, 69C or 69D of the Act. The income declared by the assessee is unrecorded stock of diamond found during the course of search. The assessee is in the business of diamond trade and such stock was part of the business affair of the company. Therefore, since income declared is in the nature of business income, the same is not taxable under any of the section referred above and accordingly section 115BBE has no application in case.”

Section 115BBE does not apply to business receipts/business turnover. Where AO had accepted after confronting the assessee with facts that undisclosed amount of assessee in his bank account was undisclosed business receipts/turnover and made additions applying @ 4% net profit margin on the amount, section 115BBE would not be attracted and revisionary order under section 263 directing AO to apply section 115BBE cannot be sustained. Only probability and likelihood to find error in assessment order is not permitted under section 263, Commissioner ought to find out specific error in assessment order [Abdul Hamid v. Income-tax Officer [2020] 117 taxmann.com 986 (Gauhati – Trib.)]

In Principal Commissioner of Income Tax, 20, Delhi v. Akshit Kumar [2021] 124 taxmann.com 123 (Delhi), it was held that where quantum figure and opening stock was accepted in previous years during scrutiny assessments, receipt from sales made by assessee proprietary concern out of its opening stock could not be treated as unexplained income to be taxed as ‘income from other sources’.

Where nature and source of excess stock found during search was not specifically identifiable from profits which had accumulated from earlier years, AO was justified in holding that said excess stock was not undisclosed investment of assessee and no case of perversity or lack of enquiry on part of Assessing Officer was made out so as to render his decision erroneous under Explanation 2 to section 263. In the present cases, explanations have been offered by the assessees that excess stock was a result of suppression of profits from business over the years and is a part of the overall stock found. In ITA Nos. 9 & 14 of 2021, the assessees concerned gave further clarification that the excess stock had been admitted in Schedule ‘L’ under the heading, ‘other operating income’ under the head “Profits and Gains of the Business” in Part A of the Return filed for the relevant Assessment Year. Hence, the excess stock could not have been treated as ‘undisclosed investment’ under section 69 of the Act. [PCIT v. Deccan Jewellers (P.) Ltd. [2021] 132 taxmann.com 73 (AP)]

AO can’t make additions u/s 69A on a hypothetical basis without carrying out enquiry to find out more details. Where assessee sold several flats during year and pursuant to search, a letter addressed to one DS showed that DS paid Rs. 57.73 lakhs towards purchase of flat, whereas agreement value with reference to same was Rs. 49.18 lakhs and Assessing Officer multiplied difference in sale price to number of flats sold and made additions under section 69A, Tribunal having accepted assessee’s explanation that initially said flat was negotiated for a sum of Rs. 59.34 lakhs, however, later booking was cancelled and thereafter it was sold at Rs. 49.18 lakhs to DS, entire additions having been made by Assessing Officer without enquiry on hypothetical basis, Tribunal had not committed any perversity or applied incorrect principles to given facts to set aside additions so made [PCIT v. Nexus Builders and Developers (P.) Ltd. [2022] 134 taxmann.com 82 (Bom.)]

*Detected otherwise than by search.

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA