Formation and Incorporation of LLP – Step by Step Process

- Blog|Company Law|

- 16 Min Read

- By Taxmann

- |

- Last Updated on 15 March, 2023

Table of Contents

2. Pre-requisites for Incorporating a LLP

3. Recent Amendments and LLP Incorporation Process

5. Registered Office of LLP and change therein (Sec. 13)

6. Effect of Registration (Sec. 14)

7. Provisions Relating to Name of LLP and changes therein (Secs. 15 – 21)

8. Limited liability partnership (Amendment) Act, 2021

1. Introduction

Limited liability partnership is a body corporate and legal entity separate from its partners. It enjoys the status of separate legal entity only after incorporation. LLP after registration can hold, acquire or dispose of all kinds of assets. It can sue others and be sued in its own name. Pre-requisites for incorporation of new LLP, provisions relating to registered office of LLP and changes therein and provisions relating to approval, reservation of name and changes there in have been discussed in the present article.

2. Pre-requisites for Incorporating a LLP

-

- Minimum two partners (Individual or body corporate).

- Minimum two designated partners who are individuals and at least one of them should be resident in India.

- Digital signature certificate

- LLP Name

- LLP Agreement

- Registered office

Dive Deeper:

Basic Primer on Limited Liability Partnership (LLP) vs. Private Limited Company

Guide to Limited Liability Partnership (LLP) Act

[FAQs] on Limited Liability Partnership (LLP)

3. Recent Amendments and LLP Incorporation Process

Major amendments have been made under the LLP incorporation Rules vide Limited Liability Partnership (Second Amendment) Rules, 2018. The Ministry of Corporate Affairs (MCA) vide its Notification dated 18th September, 2018 introduced a revamped LLP-incorporation procedure which came into force from 2nd October, 2018.

Major highlights of the amended LLP incorporation process includes the introduction of specified LLP-RUN services (similar to RUN service for Company Incorporation) for Reservation of Name for the proposed LLP. Along with LLP-RUN, MCA also introduced Form FiLLiP i.e. Form for Incorporation of LLP. Form FiLLiP is similar to form SPiCe for Company Incorporation.

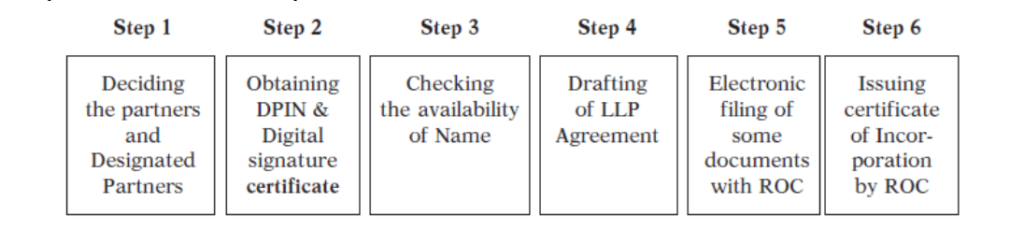

3.1 LLP Incorporation Process

Stepwise procedure for the incorporation of new LLP is discussed as follows:

Step 1: Procure Digital Signature Certificate

Every form or application is filed online with the MCA, which requires to be signed digitally by the applicants and partners of the LLP. Therefore, the DSC with validity of 2 years is procured for the Designated Partners of the Limited Liability Partnership. The DSC is associated with the PAN card of the application. It further requires passport size photograph and address proof.

Step 2: Reserve LLP Name

The new process requires the applicants to file the web form named RUN-LLP (Reserve Unique Name – Limited Liability Partnership). The similar web form – RUN is already deployed to secure company’s name. RUN-LLP has replaced the old form LLP Form 1. The new form has been simplified that requires information related to the desired name, its significance and other basic details.

The application can be made with maximum 2 names in preference order providing their significance. The names must comply with the applicable provisions for name reservation. If none of the names is approved by the MCA, another chance is provided to apply two more names.

The government fees for RUN, as per Register Office Fees Rules, shall be Rs 1,000. DSC and DIN are not required for filing of RUN form for reservation of name but account of MCA portal is mandatory. Once the name is allotted for LLP, it is reserved for a period of 90 days from date of approval.

Step 3: Preparation of Documents for Incorporation of LLP

After approval of name, LLP applicant is required to prepare the following documents:

-

- Proof of office address (Conveyance/Lease Deed/Rent Agreement etc. along with rent receipts)

- NOC from owner of the property

- Copy of utility bills (not older than 2 months)

- Subscription sheet including consent

- In case, a designated partner does not have a DIN, it is mandatory to attach: Proof of identity and residential address of the subscribers

- All the DPs should have digital signature

- Detail of LLP(s) and/or Company(s) in which partner or designated partner is a director/partner

- Copy of approval in case the proposed name contains any word(s) or expression(s) which requires approval from Central Government.

Step 4: LLP Incorporation and DIN Application

The major change in the new process is this step and application. Earlier, the incorporation application was supposed to be filed in LLP form 2, which is now replaced with FiLLiP (Form for incorporation of Limited Liability Partnership). The most significant part is integration of DIN Allotment Application with incorporation application. Below mentioned are the features of the application:

-

- DPIN/DIN application for maximum 2 Designated Partners (DPs) can be made under the application. If there are more than 2 DPs who do not hold DIN, they can be added later by following respective filings.

- With this form, the application for name reservation can also be made. However, that is kept at the option of the applicants. The applicants can either choose to reserve name through LLP-RUN or under this form.

The application is accompanied with required documents including the subscriber’s sheet and registered office address proof. The e-form will be attested by the partners through PAN based DSC and certified by the practising professional (CA/CS/CWA).

The application will be processed for approval by Central Registration Centre (CRC). If the registrar finds it necessary to call for further documents or information, he may do so by directing for re-submission within 15 days. Another opportunity of re-submission maybe provided after re-examination of application, which again has 15 days period. It is provided that the total period for re-submission of documents shall not exceed 20 days in total.

Upon approval of the application made for LLP registration online, the Certificate of Incorporation (CoI) will be issued in form 16 along with DPIN/DIN allotted to the Designated Partners. CoI will also consist of the Limited Liability Partnership Identification Number (LLPIN). The date of CoI will be the date of LLP incorporation since when it has come into legal existence. LLP is now entitled to commence business in its name.

Step 5: Apply for PAN and TAN

Unlike the in case of company, the application for PAN and TAN is required to be made separately for LLP through offline or online mode. The applications are made directly to the Income Tax Department and also processed by it. The applications are made in forms 49A and 49B respectively with Certificate of Incorporation as supporting proof.

Step 6: Drafting and Filing LLP Agreement

The next step will be to draft LLP Agreement carefully and based on the partners’ requirements. Step-4 and Step-5 both can be processed simultaneously, however, this step would take a little longer to complete than simply making the application.

3.2 Contents of LLP Agreement

The name of LLP, name and address of partners and designated partners, business object, place of business and all other essential details of LLP will be placed in the Agreement. Other clauses will be form of contribution and interest on contribution, profit sharing ratio, rights and duties of partners in case of admission, resignation, retirement, cessation and expulsion, proposed business, and rules for governing the LLP.

Once the LLP Agreement is reviewed and agreed upon by the partners, it will be executed by payment of stamp duty. The agreement will be executed by payment of stamp duty, which depends on the respective State Stamp Act where the registered office of the LLP is situated. Then with signature by partners and attestation by the witnesses, the agreement will be executed.

Notes:

-

- The agreement must be filed with MCA within 30 days of date of incorporation. The delay leads to penalty of Rs. 100/day till the date of actual filing.

- This is filed in LLP form-3 which remained same as was in the erstwhile process. Further, the verification and approval is processed by the concerned State RoC instead of CRC as in case of previous steps.

- The name allotted under LLP-RUN will be reserved for a period of 90 days. If the LLP registration application i.e. FiLLiP is not filed in given period, the name will be expired which can be reserved through new application.

- Only 2 DPIN/DIN can be allotted by through FiLLiP. In case, there are more than 2 DPs, the respective partners will be required to obtain DPIN/DIN by filing DIR-3 after incorporation. Then, the LLP need to carry on addition of Designated Partner or change in designation of Partner, as required.

3.3 Conclusive Evidence

The certificate of incorporation shall be the conclusive evidence that the limited liability partnership is incorporated by the name specified therein.

LLPIN. ROC assigns a Limited Liability Partnership Identification Number (LLPIN) for every LLP which is registered.

3.4 Incorporation Document (Sec. 11)

Section 11(1)(c) provides that a statement is required to be filed in the prescribed form along with the incorporation document. This statement shall be made by an advocate/chartered accountant/chartered secretary/cost accountant engaged in the formation of LLP as to legal compliance regarding incorporation.

3.5 Penalty

Section 11(3) provides for penalties for making statement by any person,

-

- knowing it to be false, or

- not believing it be true,

which shall not be less than ` 10,000 and may extend to ` 5,00,000 and also for imprisonment for a term which may extend to 2 years.

4. Major Amendments in LLP Incorporation Process & Other Major Amendments [LLP (Second Amendments) Rules, 2022]

The Ministry of Corporate Affairs has notified “Limited Liability Partnership (Second Amendment) Rules, 2022” vide its Notification dated 4th March 2022. The said amendment was introduced in order to amend the existing Limited Liability Partnership Rules, 2009.

4.1 Major Amendments introduced in LLP (Second Amendment) Rules, 2022 in LLP Incorporation Process

1. 5 Designated Partners instead of 2 without DIN

The major amendment introduced via Limited Liability Partnership (Second Amendment) Rules, 2022 is that now the application for allotment of DPIN shall be made by up to 5 individuals in Form FiLLiP. That means, now there can be 5 instead of 2 Designated Partners (without having DIN) at the time of Incorporation. This is a significant step towards easing the procedure of appointing more than two Designated Partners (not having DPIN/DIN) subject to a maximum of 5 Designated Partners at the time of incorporation itself.

2. Web-based process for LLP Formation

All the forms of LLP have now become web-based. Just like the SPICe Plus Forms are for the Company formation, now an LLP Incorporation Process shall be done through web-based forms only.

The second important change made in the process of LLP formation through this amendment is that now every LLP shall have to mandatorily mention Latitude and Longitude in the Address Block. The details of the Directors can be fetched from the Digi Locker Database.

3. PAN and TAN along with LLP Incorporation

As per notification the Certificate of Incorporation of an LLP shall be issued in Form 16 by the Registrar. In the said Form 16, the Registrar shall mention the PAN (Permanent Account Number) and TAN (Tax Deduction Account Number) issued by the Income Tax Department. This means that now the LLPs need not apply for PAN and TAN separately but it will be included in the process of Incorporation of a Limited Liability Partnership itself, just like it is in the case of Companies. Hence, the LLPs shall be allotted their PAN and TAN along with the Certificate of Incorporation itself.

4. Solvency Statements and Certificate of Truthfulness

With the introduction of Limited Liability Partnership (Second Amendment) Rules, 2022, the Statement of Account and Solvency shall now be signed on behalf of the LLP by its an interim resolution professional or resolution professional, or liquidator or limited liability partnership administrator in case of a bankrupt entity, while earlier the Designated Partners in charge of compliance had to sign the Statement of Solvency.

The amended rules also cover the requirement of filing a Certificate of Truthfulness and Correctness of Annual Returns of LLPs with the sales of up to INR 5 Crore or Partner’s Contribution up to INR 50 Lakhs. Now, Form 8 (Statement of Solvency and Annual Return) will specifically include Contingent Liability reporting.

4.2 Other Major Amendments

1. Consent to act as Partner. Now, Consent to act as a Partner (Form 9) will be web based. Earlier, it was offline format which has to be physically signed by the Partners.

2. Digital signature of All DPs. As Form 9 has become web based, resultantly, all Designated Partner’s digital signatures will be required at the time of incorporation of LLP. Earlier only 1 DSC of any one DP was required.

3. Form 28 and Form 29. These forms have been merged. As a result of which form 28 shall require to be filed for the Notice of:

-

-

- Alteration in the COI (Certificate of Incorporation or Registration)

- Alteration in Names and Addresses of any of the person authorized to accept the service on behalf of foreign LLP.

- Alteration in the principal place of business in India of FLLP.

- Cessation to have a place of business in India.

-

4. Changes in the LLP Deed. Every change in LLP Deed will have to be marked in Form 3 with precise information. (Earlier just deed was to be attached).

5. Annual Return. Now, Penalties and Compounding of offences shall be mentioned in the (Annual Return) Form 11

6. Place of maintenance of Accounts other than Registered office of LLP where service of notice can be made is notified shall be intimated in Form 12.

5. Registered Office of LLP and change therein (Sec. 13)

Registered Office [Sec. 13(1)]. Every limited liability partnership shall have a registered office to which all communications and notices may be addressed and where they shall be received.

Manner of Service of Document [Sec. 13(2)]. A document may be served on a limited liability partnership or a partner or designated partner thereof by sending it by post under a certificate of posting or by registered post or by any other manner as may be prescribed at the registered office. LLP is also entitled to declare any other address for the same purpose in form 12 in a manner as may be prescribed.

Note. Where the limited liability partnership agreement does not provide for such manner, consent of all such partners shall be required for declaring any other address as address for service of documents. [Rule 16(2)].

Change of Registered Office [Sec. 13(3)] A limited liability partnership may change the place of its registered office and file the notice of such change with the registrar in form 15 and manner and subject to such conditions as may be prescribed and any such change shall take effect only upon such filing.

Notes

-

- Where the limited liability partnership agreement does not provide for manner or conditions for change of registered office, consent of all partners shall be required for changing the place of registered office of limited liability partnership to another place [Rule 17(1)].

- (i) Where the change in the place of registered office is from one state to another state, the limited liability partnership having creditors shall also obtain consent of secured creditors [Rule 17(1)].

(ii) In such a case, LLP shall also publish a general notice, not less than 21 days before filing any notice with registrar, in a daily newspaper published in English and in principal language of the district in which R.O of LLP is situated and circulating in that district giving notice of change of R.O [Rule 17(4)].

Penalty for Contravention [Sec. 13(4)]. If the limited liability partnership contravenes any provisions of this section, the limited liability partnership and its every partner shall be punishable with fine which shall not be less than ` 2000 but which may extend to ` 25,000.

6. Effect of Registration (Sec. 14)

On getting the certificate of registration from the registrar of companies, the LLP enjoys the status of body corporate and becomes a legal entity separate from its members. Such LLP is entitled to exercise the following rights :

(a) It can sue and be sued by others in its own name.

(b) It can acquire, own, hold, develop or dispose of property whether movable or immovable, tangible or intangible.

(c) It may have a common seal. Thus it is not mandatory for LLP to have a common seal.

(d) It can do and suffer such other acts and things as bodies corporate may lawfully do and suffer.

7. Provisions Relating to Name of LLP and changes therein (Secs. 15 – 21)

1. Last Words of Approved Name [Sec. 15(1)]. Every limited liability partnership shall have either the words “limited liability partnership” or the acronym “LLP” as the last words of its approved name.

2. No limited liability shall be registered by a name which in the opinion of the Central Government is undesirable.

Guidelines Regarding Name for Proposed LLP

Selection of the name for the proposed LLP to be incorporated is one of the important steps in the entire incorporation process, ideally the name of the LLP must be related to the business or activity intended to be carried on by the LLP. Name must be finalized subject to the guidelines of Ministry of Corporate Affairs (MCA). These are discussed under the following heads:

(i) LLP with Identical Name. The proposed name of the LLP can be identical to the existing company/LLP provided no objection certificate has been obtained from the exiting company/LLP.

Example.

| If the Bharat Electrical Company (Delhi) is already in existence and the name of the proposed LLP is identical, the proposed LLP can be incorporated with the identical name provided the partners of LLP have obtained the ‘No objection certificate’ from such company. |

(ii) Prohibited Words. Ministry of Corporate Affairs of India has pres-cribed certain words which should not form part of the name of proposed LLP. Such words are prohibited under the Emblems and Names (Prevention of Improper Use) Act, 1950.

Example.

| Ashoka Chakra, Name of Parliament, State Legislature, Mahatma Gandhi or name of any Prime Minister etc. |

(iii) Words Based on Approval. Various Government regulatory authorities operating in India have prescribed certain words and they can form part of the name of the proposed LLP to be incorporated subject to their approval.

Example.

| Proposed words | Approval required |

| Bank, Banking | Reserve Bank of India |

| Stock Exchange, Mutual Funds | Securities Exchange Board of India |

Ministry of Corporate Affairs (MCA), Government of India vide its Circular No. 2/2014 dated Feb. 11, 2014 restricts the use of the word “National” in the names of Companies/Limited Liability Partnerships (LLPs) unless it is a Government Company and Central/State Government (s) has a stake in it. Similarly, the word “Bank” and “Stock Exchange” or “Exchange” may be allowed in the name of a entity only when such entity/promoter produces a certificate in this regard from the Reserve Bank of India (RBI) and Securities and Exchange Board of India (SEBI) respectively.

(iv) Name Reserved for Foreign LLP/Companies. Where foreign LLP/companies have reserved their name under Rule 18 of the LLP Rules, 2009, then with the similar name no other proposed LLP can be registered.

3. Reservation of Name (Sec. 16)

(i) Application. A person may apply in Form I along with ` 200 as pres-cribed fee to the registrar for the reservation of a name set out in the application. The name may be reserved relating to the name of a proposed LLP or the name to which a limited liability partnership proposes to change its existing name. In case of new LLP, such application can be made to the registrar having jurisdiction where registered office of LLP is to situate.

(ii) Reservation for 3 Months. The registrar will inform to the applicant for the reservation or non-reservation of the changed name in the above mentioned cases within seven days of the receipt of the application. Such name shall be available for a period of 3 months from the date of intimation by the registrar.

(iii) Reservation of Name of Foreign LLP. A foreign LLP or a foreign company may apply in form 25 with specified fee of ` 10,000 to the registrar for reserving its existing name by which it is registered in the country of its regulation or incorporation. Such reservation shall be valid for 3 years but may be renewed on a fresh application in form 25 along with payment of specified free of ` 5000 [Rule 18(3)].

4. Change of Name of LLP (Secs. 17-19). Change of name may take place in the following circumstances :

(i) Where the Central Government Issues the Directions for the Change of Name [Sec. 17]. If the Central Government finds that a LLP has been registered with a name which is not subject to the guidelines issued by ministry of corporate affairs, it may direct such LLP to rectify the name.

The LLP shall comply with the said direction within three months after the date of direction or such longer period as permitted by the Central Government.

Penalty for Non-Compliance [Sec. 17(2)]. A limited liability partnership which fails to comply with the above stated direction shall be punishable with fine which shall not be less than ` 10,000 but which may extend to ` 5,00,000. The designated partner of such LLP shall be punishable with fine which shall not be less than ` 10,000 but which may extend to ` 100,000.

(ii) Where the Registrar Gives Direction after the Receipt of Application from the Existing Entity [Sec. 18(1)]. An entity with a name identical to that of subsequently incorporated LLP may apply in form 23 to the Registrar to give direction on a ground laid down under Sec. 7 to change its name. Such application can be submitted within 24 months of incorporation of subsequent incorporated LLP.

(iii) Where the LLP Intends to Change its Registered Name [Sec. 19]. LLP may change its registered name by following the procedure laid down in LLP agreement. Where LLP does not provide such procedure, consent of all partners shall be required for the change of name of LLP.

Filing of Notice. Notice of change shall be given to the registrar in Form 5 within 30 days of compliance of above stated requirement along with the specified fee.

Issue of Fresh Certificate. The registrar on being satisfied shall issue a fresh certificate of incorporation in the new name and changed name will be effective from the date of such certificate.

5. Penalty for Improper Use of Words “Limited Liability Partnership” or LLP [Sec. 20]. In case any person carriers on business using the words ‘Limited Liability Partnership’ or LLP without getting incorporated as LLP, he shall be punishable with fine which shall not be less than ` 50,000 but which may extend to ` 5,00,000.

6. Publication of Name and Limited Liability [Sec. 21]. Every LLP is required to publish the following on its invoices, official correspondence and publications :

(a) The name, address of registered office and registration number of the LLP, and

(b) A statement that it is registered with limited liability.

Penalty for Contravention. A limited liability partnership which contravenes the above stated provisions shall be punishable with fine which shall not be less than ` 2000 but which may extend to ` 25,000.

8. Limited liability partnership (Amendment) Act, 2021

The amended provisions regarding name and change therein are as follows:

Names which are not allowed. The LLP (Amendment) Act, 2021 amended the Section 15(2) by substituting the following matters;

No limited liability partnership shall be registered by a name which, in the opinion of the Central Government is identical or too nearly resembles to that of any other limited liability partnership or a company or a registered trademark of any other person under the Trade Marks Act, 1999.

Change of Name of Limited Liability Partnership. The LLP (Amendment) Act, 2021 has fully substituted Section 17 of the LLP Act, 2008 and also omitted the Section 18 of the LLP Act, 2008. The provisions of amended Section 17 are as under:

1. Central Government Power to change the Name [Sec. 17(1)]. If the name of LLP is identical or too nearly resembles the name of any LLP or Company; It is identical or too nearly resembles a registered trade mark of a proprietor; The Central Government shall direct such LLP to change its name within 3 months from the date of issue of such direction. A proprietor of Registered Trademark is entitled to make an application to Central Government, i.e. Regional Director within 3 years from the date of incorporation of LLP/registration of new name in e-form INC–23.

2. Filing of Notice to the Registrar [Sec.17(2)]. Where a limited liability partnership changes its name or obtains a new name under section 17(1), it shall within a period of fifteen days from the date of such change, give notice of the change to Registrar along with the order of the Central Government, who shall carry out necessary changes in the certificate of incorporation and within 30 days of such change in the certificate of incorporation, such limited liability partnership shall change its name in the LLP agreement.

3. Allotment of New Name to LLP in case of Default [Sec. 17(3)]. Where a LLP is in default in complying the direction of Registrar for such change of name, the Registrar shall suo motu allot a new name to the LLP, which shall be ending with “ORNDC”, i.e, “Order of Regional Director Not Complied”, the year of passing of the direction, serial number and the existing LLPIN of the LLP shall become the new name of the LLP and the Registrar shall issue fresh certificate of incorporation in Form 16A and accordingly such name shall be entered in the register of LLP. The complete abbreviation “ORNDC” shall be mentioned by such non-compliant LLP in bracket below the name of such LLP, on its invoices, official correspondence and publications, till the time such LLP changes its name in accordance with Section 19. Nothing in this section shall prevent a LLP to subsequently change its name in accordance with Section 16 in future.

Dive Deeper:

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA

What additional documents are required if a body corporate is a partner in LLP?

Kindly let me know thanks.