Corporate Governance in Public Sector Units and Corporate Funding of Political Parties

- Blog|Company Law|

- 8 Min Read

- By Taxmann

- |

- Last Updated on 29 August, 2023

Topics covered in this Article are as follows:

-

Corporate Governance in Public Sector Units

1.1 Introduction

Public enterprises in India are classified under three categories—

- Departmental Undertaking,

- Statutory corporations financed by Government

- Government companies set up under the Companies Act, 2013 or Public-Sector undertakings.

This article covers corporate governance in PSUs only.

1.2 Contribution of PSUs[1]

PSUs have played an important role in the Indian economy since independence. They were created as vehicles for industrial and regional development, creation of basic infrastructure networks, and employment generation. PSUs continue to play an active role in the Indian economy. Their contribution to the economy can be judged from the fact that 320 PSUs (244 operating and 76 under construction PSUs) with a total investment of ` 11,71,844 crores earned a net profit of ` 1,15,767 crores in 2015-16. They have employed 12.34 lakh people and total Market Capitalization (M-Cap) of 46 PSUs, whose stocks are being traded, as per cent of BSE M-Cap was 11.68% during 2015-16. They contributed ` 2,78,075 crores to the central exchequer by way of dividends, taxes, etc. PSEs have done exemplary work for the upliftment of local communities by addressing their education and drinking water needs through CSR initiatives.

The Government of India (GOI) has taken a number of steps over the years to improve their performance including through better corporate governance. Table 14.1 summarizes various Public-sector reforms in India since liberalization in 1991.

- Table 1. Brief History of Public Sector Reforms in India since liberalization in 1991

| Phase of the Reform | Time Period | Key Reforms |

| Phase 1:New Industrial Policy | July 1991 – May 1996 | “De-reservation” involving liberalization of hitherto closed sectors dominated by state monopolies “Disinvestment” involving limited and partial sale of government shares “Sick” PSUs referred to the board for industrial and financial reconstruction. |

| Phase 2:Empowerment of Public Sector Undertakings | June 1996 – March 1998 | Operational autonomy granted to very large PSU Professionalisation of the Board of Directors in every PSU Disinvestment commission set up. |

| Dramatic reduction in state compliance guidelines and requirements. | ||

| Phase 3:Open Privatization | April 1998 – May 2004 | Buy-back of shares allowed Downsizing, restructuring and professionalisation of PSUs and their Governing Boards Shutting-down selected sick PSUs. |

| Phase 4:Better Governed PSUs envisaged | May 2004 – present | Corporate guidelines for PSUs introduced. |

Source: Adapted from World Bank Study entitled, “Corporate Governance of Central Public-Sector Enterprises”, 2010.

1.3 Corporate Governance Framework

Provisions as contained in the Companies Act, 2013; SEBI guidelines on Corporate Governance; and DPE guidelines on Corporate Governance for Central Public-Sector Enterprises provide the Corporate Governance framework for listed PSUs in India. SEBI guidelines are not applicable to non-listed PSUs.

- Provisions as contained in the Companies Act, 2013

The Companies Act, 2013 was enacted on 29 August, 2013 and it replaced the Companies Act, 1956. The Ministry of Corporate Affairs has also notified Companies Rules, 2014 on Management and Administration, Appointment and Qualification of Directors, Meetings of Board and its Powers and Accounts. The Companies Act, 2013 together with the Companies Rules provide a robust framework for Corporate Governance all companies including PSUs registered under the Companies Act. Some of the important requirements which have been laid down are with regard to:

-

- Qualifications for Independent Directors along with the duties and guidelines for professional conduct (Section 149(8) and Schedule IV thereof).

- Mandatory appointment of one-woman director on the board of listed companies [Section 149(1)].

- Mandatory establishment of certain committees like Corporate Social Responsibility Committee [Section (135)], Audit Committee [Section 177(1)], Nomination and Remuneration Committee [Section 178(1)], and Stakeholders Relationship Committee [Section 178(5)].

- Holding of a minimum of four meetings of Board of Directors every year in such a manner that not more than 120 days shall intervene between two consecutive meetings of the Board [Section 173(1)].

- SEBI Guidelines on Corporate Governance

- Securities and Exchange Board of India (SEBI) is the capital market regulator in India. It amended Clause 49 of the Listing Agreement in 2014 in order to align it with the Corporate Governance provisions specified in the Companies Act, 2013.

- It is applicable to all companies, including PSUs, which are listed on a recognized stock exchange. There are certain exceptions. Clause 49 has been discussed in Paragraph 18.3.

- DPE guidelines on Corporate Governance for Central Public-Sector Enterprises

-

- The Department of Public Enterprises (DPE) issued first ever guidelines on Corporate Governance in November 1992 for PSUs which were voluntary in nature.

- These have been revised from time to time, latest being the DPE guidelines in May, 2010.[2]

- These guidelines are mandatory and are applicable to all PSUs – listed or not listed.

- The guidelines issued by DPE has covered areas like composition of Board of Directors, composition and functions of Board committees like Audit Committee, Remuneration committee, details on subsidiary companies, disclosures, reports and the schedules for implementation.

- DPE has also incorporated Corporate Governance as a performance parameter in the MoUs of all PSUs.

- In July 2014, DPE issued revised guidelines for grading the PSUs on Corporate Governance.

- In order to encourage compliance with guidelines, DPE made it clear that deviation from Corporate Governance guidelines would attract negative marking in the performance evaluation of PSUs under Memorandum of Understanding process from the fiscal year 2015-16.

Dive Deeper:

[FAQs] on Accounting Aspects of Corporate Restructuring

Corporate Restructuring: Types and Importance

1.4 Issues in Corporate Governance of PSUs

Since the launch of New Industrial Policy, many Indian PSUs have grown immensely domestically as well as globally. To increase competitiveness and improve investor confidence, it is important for them to embrace corporate governance standards which would ensure further growth in an ethical and transparent manner. The major impediment in achieving desired level of competitiveness is governance deficit due to certain key issues which require immediate attention. Some of these are:

-

- Autonomy of the Board – A competent and autonomous Board is important for success of any corporate. However, Ministerial diktats may, at times, influence the Board agenda in case of PSUs and take precedence over strategic and commercial considerations. PSUs have no role even in selection of independent directors[3]. Without full operational and financial autonomy, it is difficult to have a structured performance evaluation system for the Board members and fix accountability.

- Ownership policy – There is no ownership policy in place. It is needed to clearly lay down role and responsibilities of the Government towards minority shareholders and other stakeholders such as

employees, vendors, customers and communities. The Organisation for Economic Cooperation and Development (OECD) states that “the government should develop and issue an ownership policy that defines the overall objectives of state ownership, the state’s role in corporate governance of state-owned enterprises and how this policy is likely to be implemented.” The ownership policy should be clearly disclosed and communicated to fix accountability. - Appointment of independent, non-executive directors and women directors on PSU boards – Legal provisions and Guidelines issued by SEBI and DPE have laid down requirements for the constitution of PSUs Board to ensure their independence and gender diversity. It is widely believed and empirically established that properly structured Board is necessary for ensuring objectivity of Board’s decisions and exercising oversight over decisions of Board and its Committees. Out of the top 27 PSUs, according to a recent study[4], 25 per cent do not meet the criteria for independence of the Board and nearly 25% do not have a woman director.

- Non-compliance with legal requirements and SEBI and DPE Guidelines – It is disconcerting to note that many of the top PSUs are falling behind in complying with minimum requirements envisaged in Clause 49 and DPE Guidelines. Even the compliance audit conducted by the Comptroller and Auditor General of India has highlighted this issue.

- Excessive regulation – Besides Parliament, PSUs are also accountable to other authorities like Comptroller & Auditor General of India, (CAG); Central Vigilance Commission, (CVC); Competition Commission of India, (CCI); and Right to Information Act, (RTI) etc. Over regulation has not only created accountability problems but has also killed corporate governance.

Issue of Governance deficit in PSUs should be addressed and if the PSUs have to make a mark on world business map then they should be looked at not as Government but entities running to make judicious use of resources they have been entrusted with. It is interesting to note the observation of the force behind establishment of PSUs in India, Pt. Nehru, in this context. While debating on Second Five Year Plan in Parliament, he said, “I have no doubt that the normal governmental procedure applied to a public enterprise will lead to the failure of that public enterprise. Therefore, we have to evolve a system for working public enterprises where on the one hand, there are adequate checks and protections, and on the other, enough freedom for that enterprise to work quickly and without delay.”

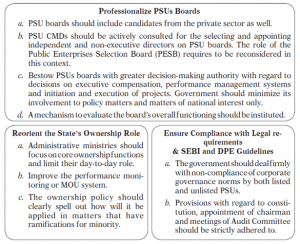

1.5 Ways to improve Corporate Governance in PSUs

PSUs are India’s most important national assets. It has been the constant endeavour of the Government to improve governance in PSUs. But it has not been able to reorient its role away from day-to-day management of PSUs towards exercising its core ownership rights based on sound corporate governance principles.

Adapted from World Bank Study entitled, “Corporate Governance of Central Public-Sector Enterprises”, 2010

-

Corporate Funding of Political Parties

2.1 Introduction

Political parties across the world need money to fight elections. They raise money either through State Funding of elections and/or Corporate Funding. State or Public funding of elections means that government gives funds to political parties or candidates for contesting elections. While Corporate funding refers to the funding of the political parties by Corporates. In India, despite the Election Commission’s commitment to the idea of State funding of elections and recommendations of various Committees[5], not much progress has been made in this direction. Hence, Corporate funding remains the main source of finance for political parties. It is, generally, in the form of donations to political parties.

2.2 Legal provisions

- The Companies Act, 2013

-

- Contributions to political parties are governed by Section 182 of the Companies Act, 2013 (the Act).

- It provides that a company that is not a Government company and which is in existence for at least last three financial years may contribute any amount directly or indirectly to any political party registered under the Representation of Peoples Act, 1951.

- Such contributions can be made only through cheque, bank draft, electronic means or any other mode prescribed by the Government.

- The Finance Act, 2017 amended section 182 of the Companies Act, 2013 and now there is no limit on the maximum amount that can be contributed by a company to a political party. Further, the requirement of disclosing the names in the Profit and Loss account of political parties to which such donations/contributions have been made, has been done away with.

- The Income-tax Act,1961

- Section 80GGB of Income-tax Act, 1961 allows an Indian company deduction from taxable income for any contribution, other than by way of cash, to any political party or an electoral trust.

2.3 Corporate Governance Issues

Corporate funding of political parties has created various governance issues. Some of these are mentioned below:

-

- Brings in corruption in the system – Existence of Politicians – Business nexus in India cannot be denied. Despite more than two decades of economic liberalization in the country, businesses remain highly vulnerable to discretionary government actions. Unreported donations are given in return for governmental favours or to buy party goodwill. (Gowda and Sridharan, 2012, p-237)[6]

- Lack of transparency – Opaqueness associated with present system of corporate funding brings with it governance issues. Companies, on many occasions, make these contributions out of unaccounted wealth. This is done essentially to protect identity of the donor and to circumvent the need for shareholder approval.

- Shell companies – One of the biggest problems associated with corporate funding is the use of shell (fake) companies to flush the unaccounted money as political contributions. In the recent past, these companies have become conduits of converting black money into white.

All the above issues cannot be addressed unless all the political parties have the willingness to do it and businesses rise above the greed for short-term gains.

[1] Figures related to PSUs have been taken from The Public Enterprises (PE) Survey, 2015-16 published by Ministry of Heavy Industries & Public Enterprises, Government of India.

[2] Detailed Guidelines can be accessed at—

http://dpe.gov.in/publications/guidelines-corporate-governance-cpses-2010

[3] For ‘Ratna’ PSUs (i.e. Maharatna, Navratna and Miniratna) names of independent directors are recommended by the administrative ministry to the Public Enterprises Selection Board, or PESB. The list of shortlisted candidates is then sent to the administrative ministry and Appointments Committee of the Cabinet makes the final selection.

[4] https://timesofindia.indiatimes.com/business/india-business/PSUs-fare-poorly-in-corporate-governance/article-show/49887036.cms

[5] Most of the Committees on State funding of elections have suggested that India should go for partial state funding. The key reports on the issue are mentioned below:

- Indrajit Gupta Committee on State Funding of Elections (1998)

- Law Commission Report on Reform of the Electoral Laws (1999)

- National Commission to Review the Working of the Constitution (2001)

- Second Administrative Reforms Commission (2008)

- Law Commission of India Report on Electoral Reforms (2015)

[6] Gowda, M. R., & Sridharan, E. (2012). Reforming India’s party financing and election expenditure laws. Election Law Journal, 11(2), 226-240.

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA