FAQs on new provision relating to TDS on purchase of goods

- Blog|Income Tax|

- 16 Min Read

- By Taxmann

- |

- Last Updated on 5 January, 2023

Is it a coincidence or an irony that TDS and Tedious sound similar? Currently, the Income-tax Act has 36 provisions which require deduction of tax at source from various payment.

FAQ on Section 194Q TDS on purchase of goods

The number is proposed to be increased to 38 by the Finance Bill, 2021. If all these provisions are projected in a table, they may look like a Periodic Table of Element. There are a few transactions or payments which may be covered under multiple provisions and to find out the relevant provision, the deductor will have to solve a complex theorem. One such transaction is sale or purchase of goods exceeding Rs. 50 lakhs.

The Finance Act, 2020, inserted Sub-Section (1H) in Section 206C to provide for the collection of tax by a seller from the amount received as consideration for the sale of goods if it exceeds Rs. 50 lakhs in any previous year. On the similar lines, the Finance Bill, 2021, proposes to insert a new Section 194Q to provide for deduction of tax by a buyer from the purchase of goods. As sale and purchase are the flip-side of a transaction, the applicability of two provisions on the same transaction may create a lot of doubts. To resolve all these doubts we have prepared a list of the Frequently Asked Questions (FAQs) about the requirement to deduct TDS on purchase of goods with effect from 01-07-2021 with a distinction between the new Section 194Q and Section 206C(1H).

FAQ 1. Who is liable to deduct tax under Section 194Q?

The tax shall be deducted under Section 194Q by a buyer carrying on a business whose total sales, gross receipts or turnover from the business exceeds Rs. 10 crores during the financial year immediately preceding the financial year in which such goods are purchased. This provision shall be applicable from 01-07-2021.

Thus, the liability to deduct tax under this provision in the financial year 2021-22 shall arise if the turnover of the purchaser was more than Rs. 10 crores in the financial year 2020-21.

FAQ 2. When tax shall be deducted under this provision?

The tax shall be deducted from the purchases made by a buyer if the following conditions are satisfied:

-

- There is a purchase of goods from a resident person;

- Goods are purchased for a value or aggregate of value exceeding Rs. 50 lakhs in any previous year; and

- The buyer should not be in the list of persons excluded from the provision for deduction of tax.The tax shall not be deducted under this provision if the tax is deductible or collectible under any other provision except Section 206C(1H). Thus, if a transaction is subject to TCS under Section 206C(1H), the buyer shall have the first obligation to deduct the tax. If he does so, the seller will not have any obligation to collect the tax under Section 206C(1H). Also, refer to FAQ 5.

FAQ 3. What shall be the timing of deduction of tax?

Tax is required to be deducted at the time of credit of such sum to the account of the seller or at the time of payment thereof by any mode, whichever is earlier. The tax shall be deducted even if the sum is credited to the ‘Suspense Account’.

FAQ 4. At what rate tax is to be deducted?

The tax shall be deducted by the buyer of goods at the rate of 0.1% of the purchase value exceeding Rs. 50 lakhs if the seller has furnished his PAN or Aadhaar, otherwise, the tax shall be deducted at the rate of 5%.

Check out Direct Taxes Law & Practice which has been the 'go-to-guide' for Professional Practitioners for over twenty years. It explains the law lucidly along with its practical application. This book incorporates all amendments made by the Finance Act 2022.

FAQ 5. Where a transaction is covered by both the provisions – TDS under Section 194Q and TCS under Section 206C(1H), who shall be liable for deduction/collection of tax?

Second Provison to Section 206C(1H) provides that if the buyer is liable to deduct tax under any other provision on the goods purchased by him from the seller and has deducted such amount, no tax shall be collected on the same transaction. Section 194Q(5) provides that no tax is required to be deducted by a person under this provision if tax is deductible under any other provision or tax is collectable under section 206C [other than a transaction on which tax is collectable under Section 206C(1H)].

Though Section 206C(1H) excludes a transaction on which tax is actually deducted under any other provision (which will cover Section 194Q as well), but Section 194Q(5) does not create a similar exception for a transaction on which tax is collectible under Section 206C(1H). Thus, the buyer shall have the primary and foremost obligation to deduct the tax and no tax shall be collected on such transaction under Section 206C(1H). However, if the buyer makes a default, the liability to collect the tax gets shifted to the seller.

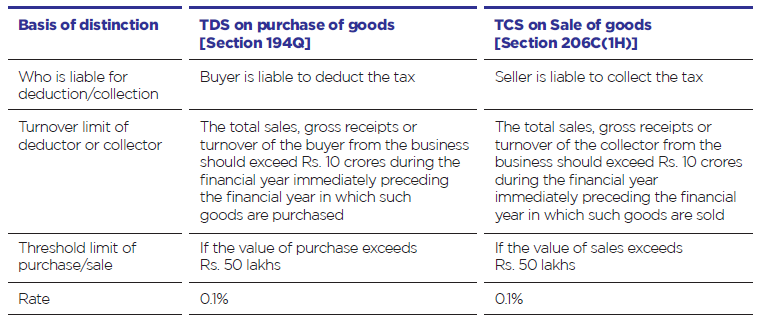

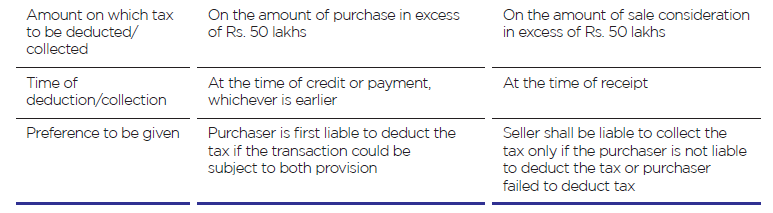

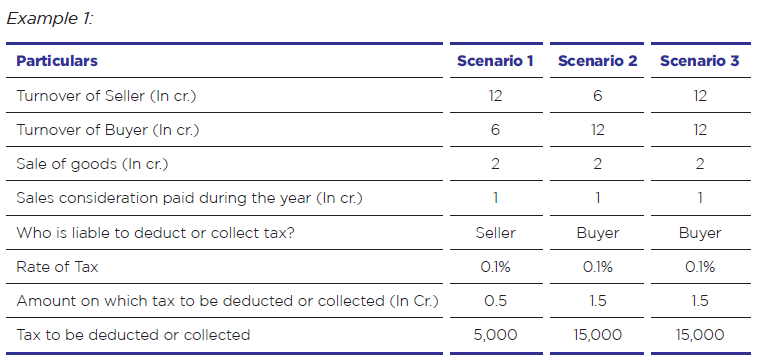

Both these provisions are distinguished in the below table:

FAQ 6. Is a buyer importing goods from outside India required to deduct tax at source under this section?

Section 194Q provides that any person, being a buyer who is responsible for paying any sum to any resident, being a seller, is required to deduct tax at source under this provision. Thus, the obligation to deduct tax under this provision arises only when the payment is made to a resident seller. As in the case of import, the seller is a non-resident, the buyer will not have any obligation to deduct tax under this provision. However, the TDS under Section 195 or payment of Equalisation Levy may be required in respect of such transaction.

FAQ 7. Whether tax is required to be deducted under Section 194Q from the goods exported abroad?

Liability to deduct tax under this provision arises only when the payment is made to a resident seller. Residential status of the buyer, who is making payment, is not relevant under this provision.

As in the transaction of export of goods, the seller is a resident but the buyer is a non-resident. Thus, the liability to deduct tax under this provision may arise on the non-resident buyer, which may not be practically possible. Thus, the Central Government may exempt such transactions in view of the powers given by the Explanation to Section 194Q.

FAQ 8. In absence of any definition of ‘goods’, what shall be construed as a purchase of

goods?

The term ‘goods’ is not defined in the Income-tax Act. The term ‘goods’ is of wide import. Anything which comes to the market can be treated as goods. However, this term ‘Goods’ has been defined under the Sale of Goods Act, 1930 and Central Goods and Services Tax Act, 2017.

Sale of Goods Act, 1930

“‘Goods’ means every kind of movable property other than actionable claims and money; and includes stock and shares, growing crops, grass, and things attached to or forming part of the land which are agreed to be severed before sale or under the contract of sale”

Central Goods and Services Tax Act, 2017

“‘Goods’ means every kind of movable property other than money and securities but includes actionable claim, growing crops, grass and things attached to or forming part of the land which are agreed to be severed before supply or under a contract of supply”

The Sale of Goods Act, 1930 is a specific statute which deals with the ‘sale of goods’ whereas the CGST Act, 2017 deals with tax on ‘supply of goods’. Thus, the definition of term ‘goods’ can be referred to from the Sale of Goods Act, 1930 for the purpose of Section 194Q.

Therefore, the tax is to be deducted under this provision from the purchase value of the following:

-

- Movable property;

- Any commodity;

- Shares or Securities;

- Electricity;

- Agriculture produce;

- Fuel;

- Motor vehicle;

- Liquor;

- Jewellery or bullion;

- Art or Drawings;

- Sculptures;

- Scraps;

- Forest produce, etc.

FAQ 9. Whether a transaction in securities through stock exchanges shall be subject to

TDS under this provision?

When the Finance Act, 2020 introduced Section 206C(1H) to provide for the collection of tax on the sale of goods, concerns have been raised about the applicability of such provision in respect of transactions through stock exchanges (or commodity exchange) as there is no one-to-one contract between the buyers and sellers.

In respect of which the CBDT vide Circular No. 17 of 2020, clarified that provisions of Section 206C(1H) shall not be applicable in relation to transactions in securities (and commodities) which are traded through recognised stock exchanges or cleared and settled by the recognised clearing corporation, including recognised stock exchanges or recognised clearing corporations located in International Financial Service Centre (IFSC).

Applying the rationale behind such clarification, it is apprehended that the CBDT may allow a similar exemption from TDS under Section 194Q as well.

FAQ 10. Whether TDS to be deducted on the purchase of immovable property by a

developer?

As referred to above, ‘goods’ means every kind of movable property subject to certain exceptions and inclusions. Thus, the immovable property shall not be treated as ‘goods’. Consequently, the TDS shall not be deducted from the purchase of immovable property by a developer.

FAQ 11. Whether TDS is required to be deducted on the transaction in electricity?

Section 194Q provides for the deduction of tax on the payment made for the purchase of goods. The Apex Court in the case of State of Andhra Pradesh v. National Thermal Power Corporation (NTPC) (2002) 5 SCC 203, held that electricity is a movable property though it is not tangible. It is ‘good’. Further, the Customs Tariff Act has covered ‘Electricity’ under heading 2716 00 00, which also clarifies that Electricity is a good. Thus, it may be concluded that the tax should be deducted from the payment made in respect of the transaction in electricity.

A transaction in electricity can be undertaken either by way of direct purchase from the company engaged in generation of electricity or through power exchanges. The CBDT has clarified that the transaction in electricity, renewable energy certificates and energy-saving certificates traded through power exchanges registered under Regulation 21 of the CERC shall be out of the scope of TCS under the provision of Section 206C(1H).

Applying the rationale behind such clarification, it is apprehended that the CBDT may allow a similar exemption from TDS under Section 194Q as well.

FAQ 12. Whether TDS should be deducted on the purchase of software?

Taxation of software has always been a subject of debate under the Income-tax Laws. The issue was also litigative under the erstwhile Indirect Tax Laws (VAT, Service Tax etc.) where states were levying VAT on the sale of goods and Centre were levying service-tax on the provision of services. With the passage of time, the Judiciary has laid down some principles, which enable the taxpayers, to determine when the supply of software would qualify as a supply of goods and when it would be a supply of services. The issue is not much litigative under the GST regime as the tax rate in both cases is the same.

However, in absence of any guidelines in the Income-tax, such classification has always been a subject matter of litigation. The Finance Act, 2012, has made the clarificatory amendments in Section 9 to broaden the scope of taxation of royalty. This has been clarified by the amendment that the consideration for the use or right to use of computer software is a royalty. The factors of the medium, ownership, use or right to use and location have been clarified as immaterial. The amendments have, thus, given a new dimension to tax administration in the sphere of royalty taxation. The payment towards royalty is subject to TDS under Section 194J or Section 195. The provision of Section 194Q would not apply where tax is deductible under any other provision.

The Supreme Court in its landmark decision of Tata Consultancy Services v. State of A.P [2004] 141 Taxman 132 (SC) held that Canned software (off the shelf computer software) are ‘goods’ and as such assessable to sales tax. Hence, the requirement to deduct TDS shall be decided on the basis whether the purchase of software has been treated as ‘purchase of goods’ or ‘purchase of service’. If the same has been treated as a purchase of service, it shall not be subject to TDS under Section 194Q but the provisions of TDS under section 194J or 195, as the case may be, may apply. However, if the purchase of software has been treated as a purchase of goods then the buyer shall be liable to deduct TDS subject to the fulfilment of other conditions of Section 194Q.

FAQ 13. Whether TDS is liable to be deducted on purchase of Jewellery not connected with business?

Tax is required to be deducted by a buyer carrying on business whose total sales, gross receipts or turnover from the business exceeds Rs. 10 crores during the financial year immediately preceding the financial year in which such goods are purchased. There is no condition that the purchases should be connected with the business only. Thus, if a person is falling within the definition of the buyer, tax is required to be deducted even if such purchase is not connected with the business carried on by him.

Jewellery, being a movable property, is covered within the term goods. There is no specific exclusion under Section 194Q for deduction of TDS on purchase of jewellery. Thus, the tax shall be deductible on purchase of jewellery if other conditions are also fulfilled.

FAQ 14. Whether additional, allied and out-of-pocket expenses form part of the purchase value of goods?

It is imperative to accurately determine the purchase value as it is relevant both for the applicability of the provision and amount from which tax should be deducted. Additional, allied or out-of-pocket charges recovered from the customers may or may not form part of purchase value. Where these expenses have been reflected in the purchase invoice itself, it should form part of purchase value. If they are charged through a separate invoice, it should not form part of purchase value.

FAQ 15. From which date the threshold limit of Rs. 50 lakhs will be computed?

The Finance Bill, 2021, has inserted Section 194Q, with effect from 01-07-2021, to provide for the deduction of tax on certain purchases. The TDS has to be deducted if the value or aggregate purchase value exceeds Rs. 50 lakhs during the previous year. How this limit of Rs. 50 Lakh for deducting TDS shall be reckoned for the financial year 2021-22? Should it be from 01-04-2021 or 01-07-2021?

Similar confusion arose when Section 206C(1H) was introduced by the Finance Act, 2020, with effect from 01-10-2020. In respect of which the CBDT vide Circular No. 17, dated 29-09-2020, has clarified that since the threshold of Rs. 50 lakhs is with respect to the previous year, calculation of sale consideration for triggering TCS under this provision shall be computed from 01-04-2020. Hence, if a seller has already received Rs. 50 lakhs or more up to 30-09-2020 from a buyer, TCS under this provision shall apply on all receipts of sale consideration on or after 01-10-2020.

Applying the same principle it should be concluded that threshold of Rs. 50 lakhs shall be computed from 01-04-2021. Thus, if a buyer has already purchased goods of value Rs. 50 lakhs or more up to 30-06-2021 from a seller, TDS under this provision shall apply on all purchases on or after 01-07-2021.

FAQ 16. Whether TDS is to be deducted on the total invoice value including the GST?

A similar issue has been raised in respect of Section 194J, to which the CBDT vide Circular No. 23/2017, dated 19-7-2017, has clarified that wherever in terms of the agreement or contract between the payer and the payee, the component of ‘GST on services’ comprised in the amount payable to a resident is indicated separately, tax shall be deducted at source on the amount paid or payable without including such ‘GST on services’ component. However, such clarification was issued in respect of GST on services only. No such clarification has been issued for GST on goods.

However, in respect of Section 206C(1H), the CBDT vide Circular No. 17, dated 29-09-2020, has clarified that since the collection is made with reference to receipt of the amount of sale consideration, no adjustment on account of indirect taxes including GST is required to be made for the collection of tax under this provision. Since deduction under Section 194Q is to be made with reference to the purchase value, applying the same principle it can be concluded that GST shall form part of the purchase value, therefore, the TDS is deductible on the purchase value inclusive of GST.

FAQ 17. Whether TDS has to be deducted on advance payment made to the seller?

Section 194Q provides that tax is required to be deducted in the transaction relating to the purchase of goods. It does not mention whether such purchase needs to be effected immediately or at a future date. As the tax is required to be deducted at the time of payment or at the time of credit, whichever is earlier, it should be reasonable to conclude that the provision may get attracted even if such purchase happens in future.

As long as the intention is to adjust the advance payment against the future purchase of goods, the tax should be deducted at the time of payment or credit, whichever is earlier. If the advance payment is not made with an intention to adjust it against future purchase (deposit or loan) but eventually it is adjusted against the future purchase, no tax is required to be deducted at the time of payment of such advance. In such case liability to deduct tax will arise the moment such advance is adjusted against the purchase value of goods.

FAQ 18. Whether payment of advance before 01-07-2021 for purchase of goods will be subject to TDS?

The Finance Bill, 2021, has proposed to insert Section 194Q with effect from 01-07-2021. Thus, provisions of this Section shall not apply on any payment made or credit made in the books of accounts before 01-07-2021. Consequently, it would apply to all purchases made on or after 01-07-2021.

In simple words, the tax should be deducted where the payment is made or amount is credited on or after 01-07-2021. Thus, where any of the trigger event (i.e., payment or credit) has occurred before the date of applicability of provision, no liability to deduct tax will arise.

FAQ 19. Whether the amount advanced as a loan to the seller shall come within the ambit of this provision?

The requirement to deduct TDS under this provision arises if the purchase value exceeds the threshold limit during the previous years. The deduction is to be made at the earliest of payment or credit for the purchase of goods. Since the loan advanced by buyers is not a payment towards the purchase of goods, it shall remain outside the purview of this provision. Hence, there is no requirement to deduct TDS on loan advanced by the buyer. However, if at any future date, such loan amount is settled against purchased value, the liability to deduct TDS shall arise. The tax shall be deducted on the date on which parties agreed to adjust the loan amount against the outstanding liability.

FAQ 20. Whether tax to be deducted on the purchase of goods by one branch from another?

The TDS under this section is required to be deducted by any person, being a buyer, responsible for making payment to the seller for the purchase of goods. Thus, the existence of two distinct parties as ‘seller’ and ‘buyer’ is a pre-requisite to construe a transaction as a purchase. The condition of purchase is not fulfilled in the context of branch transfer. Therefore, the provisions of this section shall not apply in the case of branch transfers.

FAQ 21. What shall be the treatment of debit note for computation of TDS?

As the tax has to be computed on the purchase value, the adjustment made to the ledger of the seller by issuing the debit note will not have an impact on the tax to be deducted. The position would remain the same if, after the deduction of tax, the seller repays some consideration to the buyer. In such a situation, the amount of purchase value shall not be reduced with the amount so refunded or the debit note so adjusted for calculation of TDS.

FAQ 22. If the seller has multiple units, whether purchases made from different units need to be aggregated?

Where tax is required to be deducted at source, the deductee is required to furnish his PAN or Aadhaar number to the deductor failing which the tax is required to be deducted at higher rates. If the PAN or Aadhaar number is available, the threshold limit of Rs. 50 lakhs shall be computed in respect of each PAN or Aadhaar number. In other words, if different units of the seller are under the same PAN or Aadhaar number, the amount paid or payable to all such units shall be aggregated to compute the limit of Rs. 50 Lakhs.

FAQ 23. Can a seller apply for the certificate for lower deduction of TDS?

An assessee can apply to the Assessing Officer to issue a certificate for deduction of tax at lower rates. Such certificate shall be issued if existing and estimated tax liability of assessee justifies deduction of tax at a lower rate. Further, certain assessees have an option to file a declaration for nil deduction of tax.

However, the Finance Bill, 2021, has not proposed to extend the benefit to apply for a certificate for deduction of tax at lower rates or to file declaration for nil deduction in respect of transactions covered under Section 194Q. Hence, the assessee does not have the option to approach the assessing officer to issue a certificate for a lower tax deduction or to file declaration for nil deduction in respect of transactions covered under section 194Q. In fact, Section 206C(1H) also does not allow the buyer to apply for the lower or nil TCS certificate.

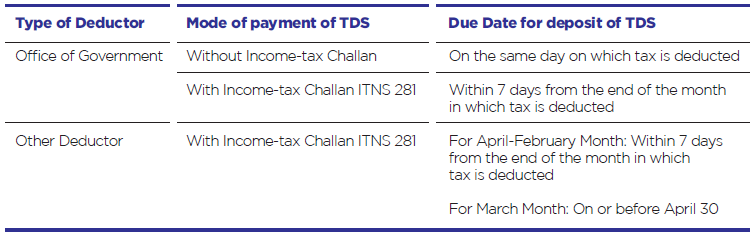

FAQ 24. How to deposit the TDS?

A corporate assessee and other assessees (who are subject to tax audit under Section 44AB) will have to make payment of tax (including TDS) electronically through internet banking facility or by way of debit cards. To deposit the tax, the deductor has to fill the Challan No. ITNS 281.

Other deductors can deposit the tax so deducted into any branch of the RBI or the State Bank of India or any authorized bank.

FAQ 25. What is the due date to deposit TDS?

Tax deducted during the month shall be deposited on or before the following due date:

FAQ 26. What shall be consequences for failure to deduct or pay TDS?

If any person, responsible for deduction of tax at source, fails to deduct the whole or any part of the tax or after deduction fails to deposit the same to the credit of the Central Government, then he shall be deemed to be an assessee-in-default.

If deductor fails to deduct tax at source, he shall be liable to pay interest at the rate of 1% for every month or part thereof on the amount of tax he failed to deduct. However, if he fails to deposit the tax deducted at source, he shall be liable to pay interest at the rate of 1.5% for every month or part thereof on the amount of tax he failed to deposit to the credit of the Central Govt.

FAQ 27. Whether buyer shall be treated as assessee in default if the seller pays the tax due on the income declared in the return of income?

Section 201 of the Income-tax Act provides that a deductor, who fails to deduct tax at source, is not deemed to be in default if the payee has considered such amount while computing income in the return and has paid the tax due on such declared income. The deductor will have to obtain a certificate to this effect from a Chartered Accountant in Form No. 26A and submit it electronically.

Thus, the buyer shall not be deemed as assessee-in-default if the seller has taken into account the purchase amount while computing his income and has paid the tax due on the income declared in the return.

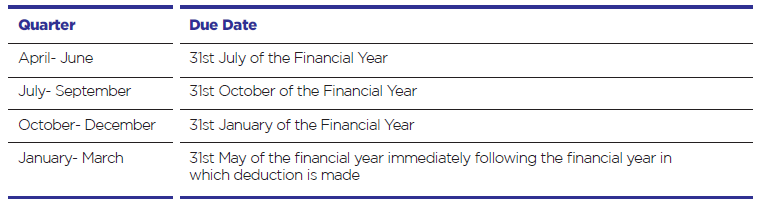

FAQ 28. What is the due date for filing of TDS return?

The statement of tax deducted at source under this provision shall be filed with the Income-tax Department on or before the following due date:

FAQ 29. What shall be consequences of non-filing of TDS return?

If there is a delay in filing of TDS return, the late filing fee shall be payable under Section 234E. The fee for default in furnishing the TDS/TCS Statement shall be levied at the rate of Rs. 200 per day during which such failure continues. However, the amount of fee shall not exceed the total amount deductible or collectable, as the case may be. The fee shall be payable before submission of the belated TDS/TCS Statement.

If a person fails to file the TDS return or does not file it by the due dates, he shall be liable to pay penalty under Section 271H. The penalty under Section 271H is also levied in case of furnishing of inaccurate information under TDS return. The minimum amount of penalty for failure to furnish TDS return or providing inaccurate information therein is Rs. 10,000 which can go up to Rs. 1,00,000.

The key to hassle-free TDS Compliances Taxmann's eTDS software- File your TDS return easily within minutes Trusted by 10,000+ Clients. Start filing your TDS/TCS return now!

Disclaimer: The content/information published on the website is only for general information of the user and shall not be construed as legal advice. While the Taxmann has exercised reasonable efforts to ensure the veracity of information/content published, Taxmann shall be under no liability in any manner whatsoever for incorrect information, if any.

Taxmann Publications has a dedicated in-house Research & Editorial Team. This team consists of a team of Chartered Accountants, Company Secretaries, and Lawyers. This team works under the guidance and supervision of editor-in-chief Mr Rakesh Bhargava.

The Research and Editorial Team is responsible for developing reliable and accurate content for the readers. The team follows the six-sigma approach to achieve the benchmark of zero error in its publications and research platforms. The team ensures that the following publication guidelines are thoroughly followed while developing the content:

- The statutory material is obtained only from the authorized and reliable sources

- All the latest developments in the judicial and legislative fields are covered

- Prepare the analytical write-ups on current, controversial, and important issues to help the readers to understand the concept and its implications

- Every content published by Taxmann is complete, accurate and lucid

- All evidence-based statements are supported with proper reference to Section, Circular No., Notification No. or citations

- The golden rules of grammar, style and consistency are thoroughly followed

- Font and size that’s easy to read and remain consistent across all imprint and digital publications are applied

CA | CS | CMA

CA | CS | CMA

Is 194Q applicable of purchase of capital goods/ fixed assets?

Sale of Goods Act does not cover capital goods and hence 194Q is not applicable. However the buyer may deduct TCS since it is a goods for him.

Errata

However Seller* may deduct TCS since it is a goods for him.

Does the amount of TCS to be deducted on amount of goods inclusive of GST?

IS 194Q applicable of purchase of diesel ???

Dear Mehul,

As you can read that, this provisions also applies to purchase of fuel.

So on purchase of diesel 194Q will be applicable.

Whether section 194Q is applicable on purchase of diesel, petrol lubricant from Indian oil. BPCL etc

Is 194 Q applicable on purchase of fuel from BPCL ?

Have you got answer

Yes. If a person falls within the definition of buyer and goods are purchased for a value or aggregate value exceeding Rs. 50 lakhs in any previous year, tax is required to be deducted under Section 194Q.

Is 194q applicable on purchases of agricultural produces from farmer

Hi Is TDS applicable on purchase of Air tickets & Hotel expenses – on a corporate level -Payment mode is through Corporate Card.

Whether TDS to be deducted on value including GST?

I am a trader(Proprietor) with turnover including GST above 10 crores(excluding GST below 10 crores). u/s. 194Q I am deducting TDS of my suppliers voluntarily though my turnover without GST below 10 Cr.

Question: Now that because I have taken this step of deducting TDS, am I liable to charge TCS to my customer even if my turnover(excluding GST) is below 10 Cr.?

when bill of purchase of paddy or rice is received in that final amt brokerage is included in brokerage we deduct t.d.s under section 194H . whether t.d.s will be deducted under section 194q on full amt or not?

Section 194Q provides that no tax is required to be deducted where tax is deductible or collectible under any of the provisions of this Act other than a transaction to which Section 206C(1H) applies. Since TDS under Section 194H has been deducted on brokerage amount and not on purchase transactions, it is advisable that tax should be deducted under Section 194Q on purchase value excluding brokerage.

In reference to above question. A single invoice consist of the purchase vale of paddy and amount of brokerage also. In that case Please clarify if TDS u/ s 194H on the brokerage amount and TDS u/s 194Q on the purchase value of paddy may be deducted?

Can TDS under both the section may be deducted on a single invoice?

Whether the TDS 194Q is applicable on total invoice value including GST/Freight charges/Packing & Forwarding/Insurance or only on basic purchase value.

Additional, allied, or out-of-pocket charges recovered from the customers may or may not form part of purchase value. Where these expenses have been reflected in the purchase invoice itself, they should form part of the purchase value. If they are charged through a separate invoice, it should not form part of the purchase value.

However, in respect of GST, CBDT vide Circular No. 13 of 2021 has clarified that tax under this provision shall be deducted on the amount credited without including GST if the specified conditions are satisfied.

However, if the tax is deducted on a payment basis because the payment is earlier than the credit, the tax would be deducted on the whole amount as it is not possible to identify the payment with the GST component of the amount to be invoiced in the future.

dear sir, goods purchase in june.2021 and already suffered tcs should i pay again tds on payment if i do in july?in july some parties has collected tcs in bill[ not applicable to me] should i pay again tds on payment?

what is the N P CODE FOR 194Q TDS PAYMENTS?

iam comes under sec 194Q

for the first time we are purchasing goods from the party value 60 lakhs , Whether we are required to deduct TDS on whole amount or 10 lakhs

Tax is required to be deducted from the purchase value exceeding Rs. 50 lakhs.

We have paid an advance of Rs. 6,00,000/- and deducted TDS as per the provision of 194Q. But the vendor has charged material and freight price in the same invoice. Here we need to adjust the freight amount also from the same advance.

How to charge TDS on freight as it will attract 194C

Dear Sir,

Whether purchase of MEIS license fall under the definition of Goods ?

is we require to deduct TDS U/s 194Q on MEIS License purchase ?

MEIS license/Duty credit scrips are considered as ‘goods’ as they are documents of title fall under heading 4907 of the Customs Tariff Act. Reference in this regard can also be made to Yash Overseas v. CST (2008) 8 SCC 681 = 15 STT 375 = 17 VST 182 (SC 3 member bench), wherein it was held that DEPB has intrinsic value that makes it marketable commodity. Accordingly, the provisions for deduction of tax at source (TDS) under section 194Q shall apply to a buyer, paying sum, for purchase of MEIS license.

Whose tds is to be book in case of we done payment to Indian Oil Company & diesel purchase from dealer ?

If you are purchasing diesel from a dealer of Indian Oil Company then TDS shall be deducted in the name of such dealer.

My question is that for calculating turnover as per 194Q and 206C 1H, export turnover is excluded or included?

Yes, export turnover shall be included to calculate the threshold limit

My question is- We are purchasing diesel by using BPCL card. We use this card for buying the diesel from the agencies. In this case from whom should we deduct TDS?

BPCL or The agency because we won’t be making any payment to the agency. We make payment to BPCL only for recharging the card. And inturn the agency gives invoices for purchasing the diesel using the card. Please clarify from whom should we deduct TDS?